REITs in the Philippines are a relatively new investment with the first REIT being listed in only 2020. However, since then, they have gained popularity with investors as a way to generate passive income and invest their hard-earned savings. This is the REITs Philippines Full Explainer & Guide.

What are REITs?

REIT really just stands for Real Estate Investment Trust. While that’s a bit complicated to digest, how they work is actually quite simple. Let’s break this down into five main features: 1) Invest in Real Estate 2) Investment Funds, 3) A Subsidiary (Mostly), 4) Dividend-Paying, 5) Different “Flavors.”

REITS Invest in Real Estate

This may be a little obvious, but you’re probably wondering what type of real estate? Well, the answer is really any, but the key feature is that the real estate has to be income-generating, which means they lease it out to other businesses (or individuals) to use the real estate.

REITS Are Investment Funds

This means that it gathers a lot of investments from different investors (usually in the form of cash). A REIT, then, takes this cash and invests it in real estate where investors can indirectly own the real estate.

That’s a bit of an oversimplification, what’s more likely to happen is that a bigger company forms a REIT and then sells the shares of those REITs for cash to fund new operations. However, it has more or less the same effect.

It’s important to note two things here: Firstly, you own the fund; not the real estate itself. That means you can’t go onsite and just start commanding people to do things for you. However, the lack of control also leads to the lack of hassle. Secondly, that means that there are fund managers that manage the real estate, which brings us to the second point.

REITs are (Mostly) Subsidiaries

While not strictly necessary, REITs are mostly subsidiaries. This means that they’re owned by a bigger company that helps manage their operations AND allows for new property acquisition. It is, thus, important to consider who is the main company behind a REIT and what potential properties can be bought by the REIT. For example, AREIT is backed by Ayala Land Inc., VREIT is backed by Vista Land & Lifescapes Inc., etc.

REITs are Dividend Paying

The most attractive feature of REITs is that they are required by law to pay out 90% of their net income from their properties. This means (nearly) everything they earn is simply paid out in cash to investors. This is why REITs are so attractive because they essentially provide the cashflow and benefits of real estate without any of the hassles of traditional real estate investments.

REITs have Different “Flavors”

The most attractive feature of REITs is that they are required by law to pay out 90% of their net income from their properties. This means (nearly) everything they earn is simply paid out in cash to investors. This is why REITs are so attractive because they essentially provide the cashflow and benefits of real estate without any of the hassles of traditional real estate investments.

Below, for example, are some companies that deal with very different properties.

| REIT Name | Main Properties |

|---|---|

| Vista REIT (VREIT) | Malls & Offices |

| Citicore REIT (CREIT) | Solar Farms & Leases to Solar Farms |

| Ayala REIT (AREIT) | Offices, Shopping Centers, Industrial Lots, Hotels |

| Premiere Island Power REIT (PREIT) | (For Power Companies) Land, Buildings, and Machinery |

None of these are recommendations, but more just to demonstrate the variety of REITs available here in the Philippines.

Who are REITs for?

Here, it would probably more useful to devise the risks and rewards of REITs:

| Rewards / Pros | Risks / Cons |

|---|---|

| Dividend-Paying – 90% of the income is paid out every year! | No control – Puts you at risk of poor management & the whims of a big company |

| Hassle-Free Real Estate – Provides access to real estate without any of the hassles | Real Estate Risks – No tenants, falling property prices, etc. |

| Low Upfront Capital – You can invest in REITs for a couple thousand at a time, which makes it great for beginners. | Share Dilution – It’s possible for companies to issue more shares than it makes sense (thereby, diluting your share). |

| Liquid – This means that you can sell your REIT share at any time if you need it. | Subject to Management Fee – The property manager also charges a fee for managing the properties |

| Diversified Real Estate – You also get a lot of different properties with a lot different tenants compared to a single property | At risk of central bank interest rates – REITs both loan to buy properties and their value is directly tied to the interest rates. Generally, higher is worse for REIT prices and the loans they take on. |

| Market Fluctuations – The prices of REITs aren’t guaranteed. |

To conclude, here are largely the category of investors REITs cater to.

- Need cashflow from their investments

- Want to invest in real estate without the hassle

- Want to invest in real estate without the large upfront capital (especially those of commercial and industrial properties).

- Need diversification for their portfolio.

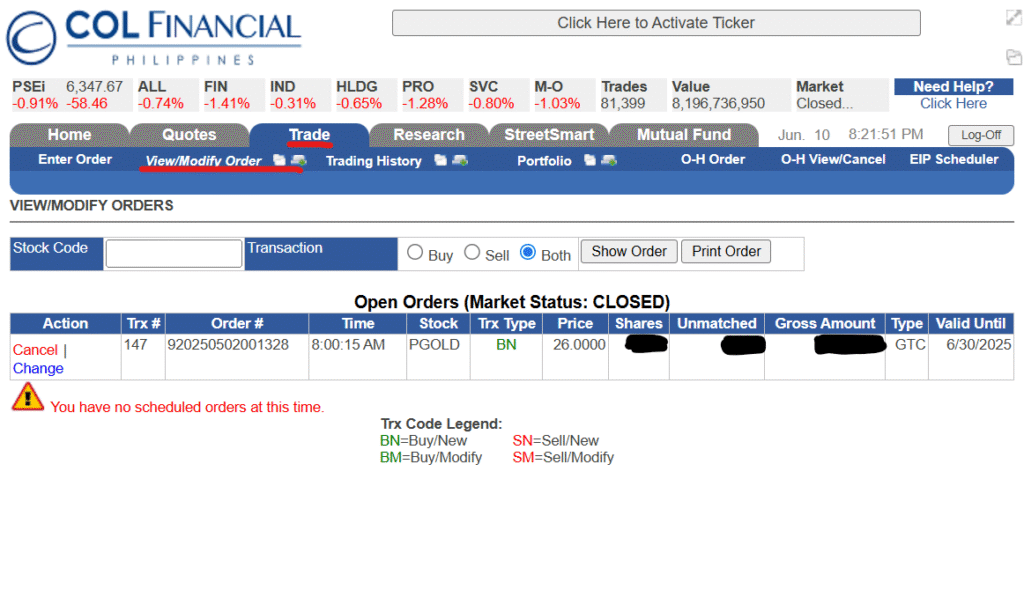

How can I buy REITs?

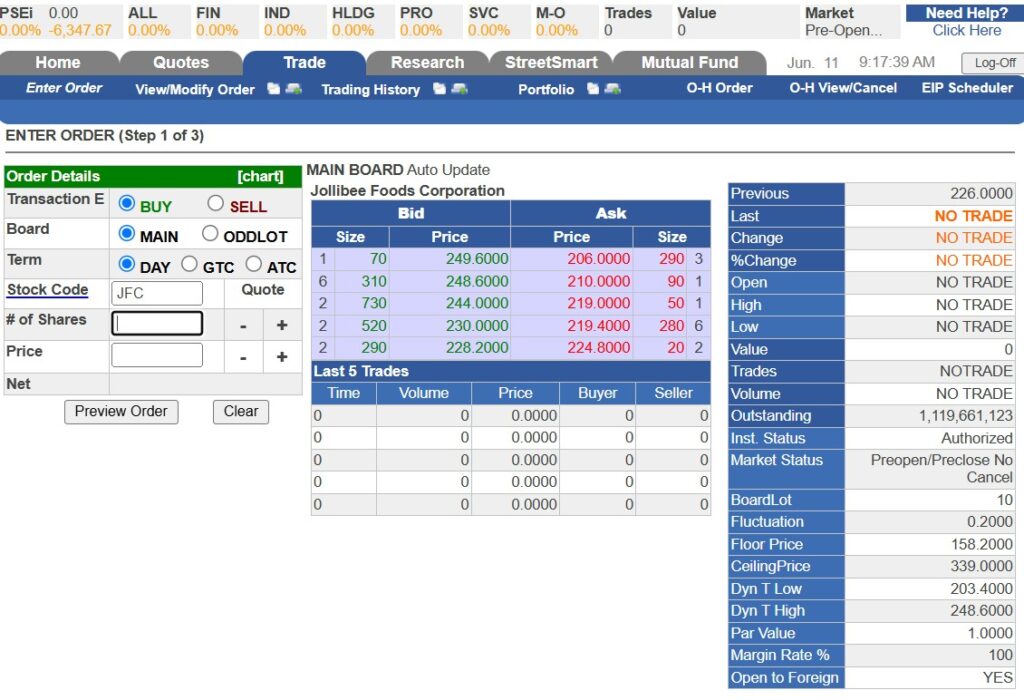

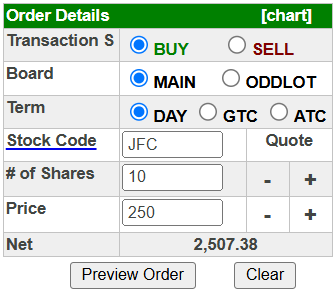

REITs are as easy as buying any other stock, where you can find an in-depth guide here (from no account to buying stocks). Broadly speaking, though, here are the simplified steps!

- Open a stockbroker account online!

- (Additional Step for REITs) Give consent to your stockbroker to create an Name-on-Central Depository (NoCD) account!

- Buy the REIT as you would any other stock! Just be sure to enter the right stock ticker code.

Alternatively, you can also invest in REIT investment funds (investment funds that invest in REITs) such as those offered by AXA and Manulife. Though, right now, there are no funds specifically dedicated to Philippine REITs (only a mix of different parts of the world like Asia or the US).

REITs Philippines: The Best Investment?

While REITs can be an amazing investment for average people, it also really depends on the type of investor someone is. Not everyone can handle the market fluctuations and some prefer having control. Others, however, prefer a passive investment or may be just be starting on the journey. In other words, it depends more on the investor than the investment.

Whatever situation that may be, we hope that this guide on REITs Philippines sheds light on your investment journey and gives you more ideas on how to invest your hard-earned savings. Remember to save and invest regularly and consider all risks when investing!