This is how to invest in stocks. Investing in stocks can be a rewarding experience that will prepare you better for your future. The following guide is a very quick and easy guide to opening stocks.

Table of Contents

1) Prepare Requirements for Stock Account Opening!

To invest in stocks in the Philippines, you need the following (if you’re a Philippine citizen):

- One (1) Valid Primary Government ID (such as, but not limited to Passports, National ID)

- A Philippine Bank Account

- A Philippine Tax Identification Number (TIN) -> See how to get one here!

- Social Security System (SSS) Number / Government Service Insurance System (GSIS) Number / Common Reference Number (CRN)

- Working Camera in your device (to take a selfie with your ID)

For those who are not only Philippine citizens or not at all, there are additional requirements:

- For non-resident foreigners: 1 valid passport

- For resident-foreigners: 1 valid passport, ACR I-Card/SIRV/SRRV/ work permit from DOLE

- For dual citizens: 1 valid passport & dual citizenship papers

- For US persons: 1 US government-issued ID and accomplished W9 or W8-BEN IRS form

2) Choose your online stock broker!

A broker is basically a company that connects you to the rest of the stock market. There are lots of options for online brokers here in the Philippines. It’s really just up to you what you want, but here is a list of the most popular brokers.

- COL Financial

- Pros: Popular, Longstanding, Veteran Analysts, Low Minimum Deposit (PHP1000), Access to 70+ Mutual Funds

- Cons: Not as user-friendly, No Mobile App (technically there is, but it’s hard to access).

- DragonFi

- Pros: Popular, User-Friendly, Low Minimum Deposit (PHP1000), Mobile App

- Cons: Newest Broker, only has access to Manulife mutual funds

- PhilStocks Financial

- Pros: Testimonials from Clients, Longstanding, Mobile App

- Cons: Not as user-friendly, Higher Minimum Deposit (PHP5000)

Your bank will also likely have a broker. For example, BDO has BDO Securities, BPI has BPI trade. So, you can also open with them as that may be more convenient and incur less fees than.

3) Register with your stock broker!

Each broker has a different process, but as long as you have your requirements ready, you should be all good! Here are some tips to opening an account:

- Be sure to read the terms & conditions (your broker may have terms you don’t like)

- Be sure to follow the instructions as best as possible! It usually prevents a lot of headache of having to resubmit.

- Have your requirements ready and scanned clearly (you can use camscanner on the phone)

- Set a STRONG password and NEVER give it away! Many times people get “hacked” simply because their password was weak or they accidentally gave it to a scammer

After that, all you have to do is wait for your broker to process your documents. Be sure to watch your e-mail!

4) Fund your stock broker!

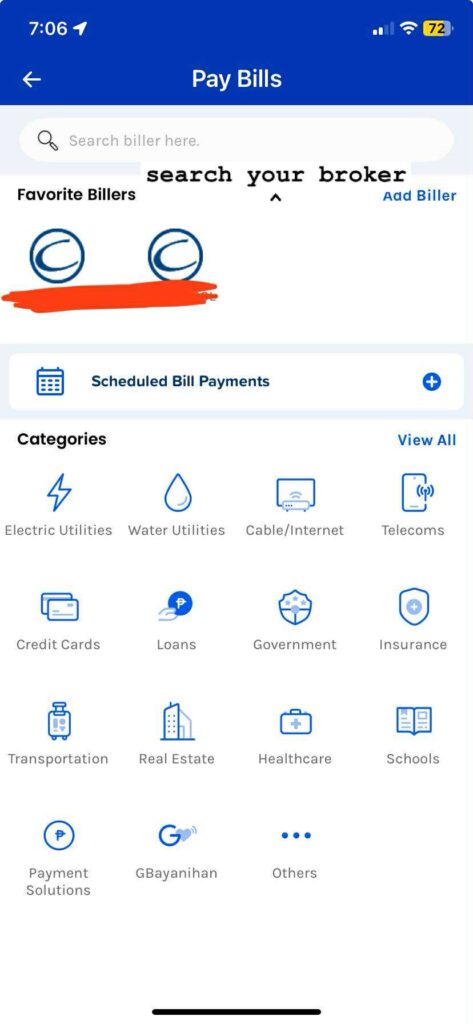

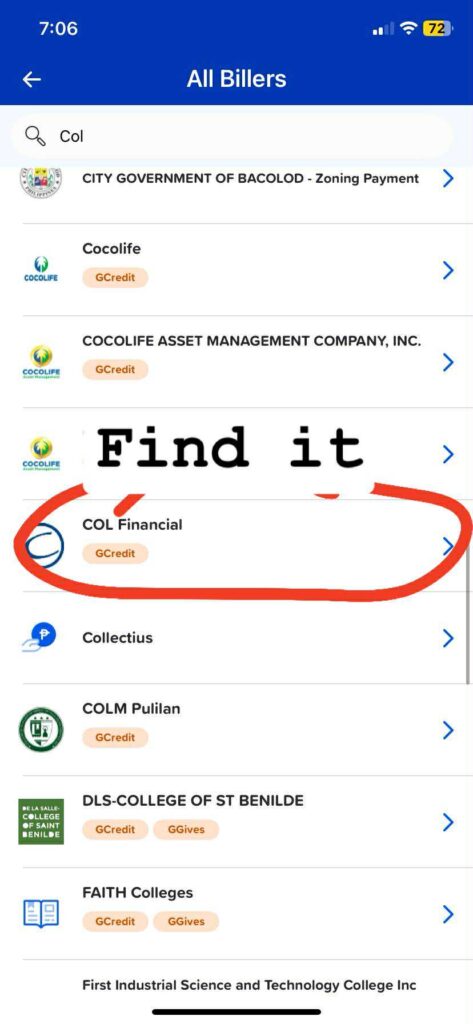

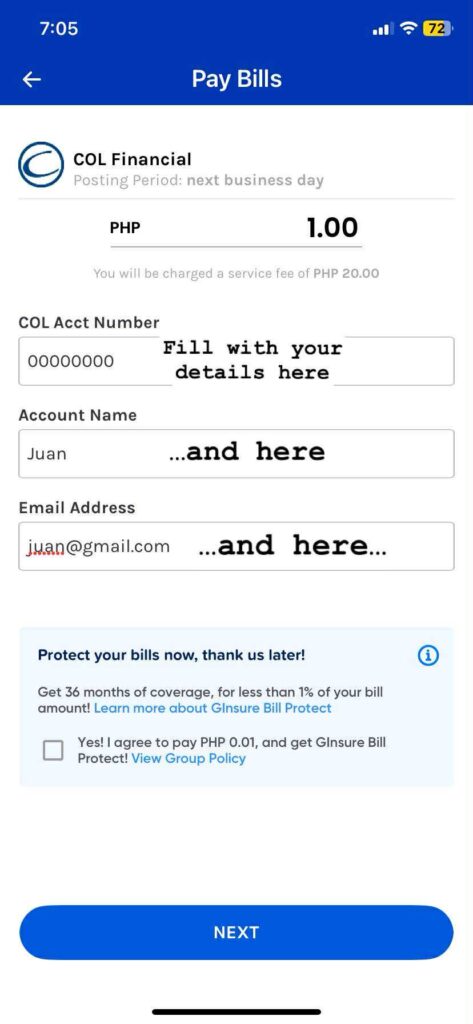

Once the brokerEach broker will naturally have different ways of being funded, but usually, this involves going to the bills payment of your bank and typing in your account number. Below is a sample for COL Financial from GCash:

Sometimes though, you need to use bank transfers like in the case of DragonFi. While we can’t cover all of them here, just check with your broker. They’ll definitely have a guide to cover for their specific situation.

5) Choose your Investment Strategy!

You’re on your way to becoming a real investor! Now, you may want to start researching and choose your investment strategy to buy stocks. As a beginner, you might want to look into:

- Cost Averaging

- Index Investing

- Dividend Investing

- Growth Investing

- Value Investing

While you can mix and match these strategies, it’s best to keep things simple when you start out. Remember that a lot of your returns still rely on the amount of money you can save rather than your investment returns.

6) Place your Trade!

Once your broker gets back to you, you can place your “trade.” This is where you actually buy stocks. While we can’t cover all brokers here, generally, here’s what you need:

- Stock Ticker Symbol: Symbol that represents the stock you want to buy. For example, Jollibee’s symbol is JFC, BDO is just BDO, SM is a little tricky: there’s SM Investments Corporation (SM), then there’s SM Prime Holdings (SMPH); just be sure to know the difference!

- Amount of Shares You Want to Buy: You have to keep in mind the “board lot.” Think of board lots as bundles, you can’t buy stocks separately you have to buy it in certain set bundles. Some stocks you’ll need to buy 5 at a time, others you’ll need to buy 100 at a time.*

- Cash to buy: Above all else, of course, you do need the cash to buy the actual stocks and the minimum amount according to the board lots.

7) Investor ka na!

After all that, you have just become an investor and you can take part in the success of large companies. As an old saying goes…

The best time to plant a tree was 10 years ago. The second best time is today. – Chinese Proverb

You’re making a serious and important step towards your future self — that one day, you may be more financially free, but to grow that tree of investing, you need to keep tending to that tree. Keep saving, be patient, and laban lang!