This article is an introduction into a variety of stock investing strategies for Philippine stocks. Choosing an investment strategy can help you make the right decisions from the get go and maximize your returns. Furthermore, the right investment strategy will help you stick with it into old age.

By the way, if you don’t understand any term, you can scroll all the way to the bottom to see a glossary of important terms.

Table of Contents

Disclaimers

This is not about asset allocation. While others may be focused more on asset allocation (i.e. how much to dedicate towards stocks or bonds, etc). This article will focus more on how to invest in stocks in particular. So, whether your allocation into stocks is 20% or 80%, the strategies can remain more or less the same: it’s just a matter of how much effort you’re willing to pull in with it.

This is not about short-term trading. This is not day-trading. this is not some get rich quick scheme, these are strategies at least executed over a few years preferably decades. While some people argue that trading is the better way to make money, they might be right, but this isn’t what this article is about.

Your capital is at risk. Keep in mind basic personal finance advice here: never invest something you can’t afford to lose. Keep it in a government-backed security or better yet, don’t invest it at all. It’s always going to be your choice whether or not to act on the information here and, at the end of the day, you always need to do your own research and make sure that this is something you want to do. This article is, at best, an introduction. Manage your risk appropriately.

Why is it important to choose consider stock investing strategies?

“Regardless of what happens in the markets, stick to your investment program. Changing your strategy at the wrong time can be the single most devastating mistake you can make as an investor.” — John Bogle

Sticking with it for a long time. As you’ll see in your investment journey, choosing stocks depends more on the type of person you are rather than optimizing for a few extra percentage points. It matters because its less about having the “optimal” strategy, but having the will to stick with that strategy for a very long time. This way: you’re able to stick through the biggest gains of the market

“Know what you own, and know why you own it.” — Peter Lynch

Knowing why you own things. If you have an investment strategy, it also covers the second part of this quote by world famous investor, Peter Lynch. The fact of the matter is that you have to know why you own the things you own and you can’t do that without deliberate action. It also allows you to also think about how much risk you’re taking on and whether or not its appropriate for your situation.

Best for Beginner & Passive Investors: Index Investing / Mutual Fund Investing

This strategy is for beginner investors or passive investors. These are people who are either: starting out and want to learn first before throwing more money into the stock market or these are people who have busy working lives, but don’t have the time or energy to dedicate to stock-picking. There’s nothing wrong with that by the way. It’s just important to be open and honest about it.

Basically, the process of index investing involves:

- Choosing a mutual fund based on what you want. Some mutual funds invest in stocks, some in bonds. For stocks, they main difference really lies in:

- Do you want to collect dividends? If yes, find a fund that pays dividends like the Manulife Global Multi-Asset Diversified Income Feeder Fund or the PhilEquity Dividend Yield Fund.

- Do you want lower fund fees? If yes, you might want to find a fund that follows an index (which is a group of companies, usually the most valuable ones (ala SM, BPI)) such as the PhilEquity PSE Index Fund & ALFM Index Fund. Here in the Philippines, most providers follow the PSEi which invests in the 30 most valuable companies.

- Do you want active management? On the other hand, some people will be more comfortable with investing in people who seek to outperform the average like the PhilEquity Fund (which since its launch has beat the market by 10% every single year as of writing).

- Note: I am not affiliated with any companies, I just think these funds are solid and have a long track record (especially those of PhilEquity) nor am I affiliated with the other funds.

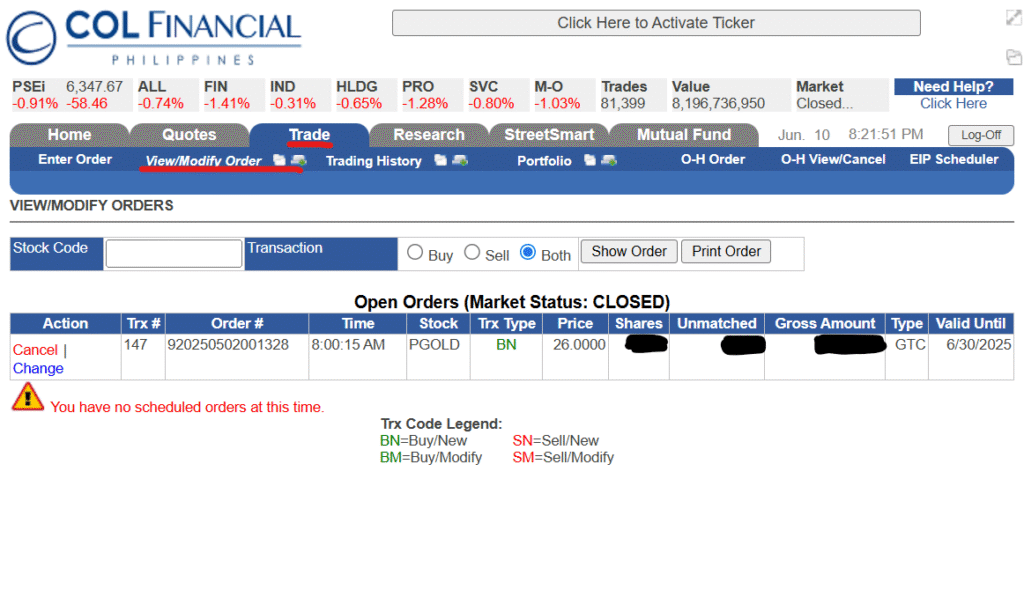

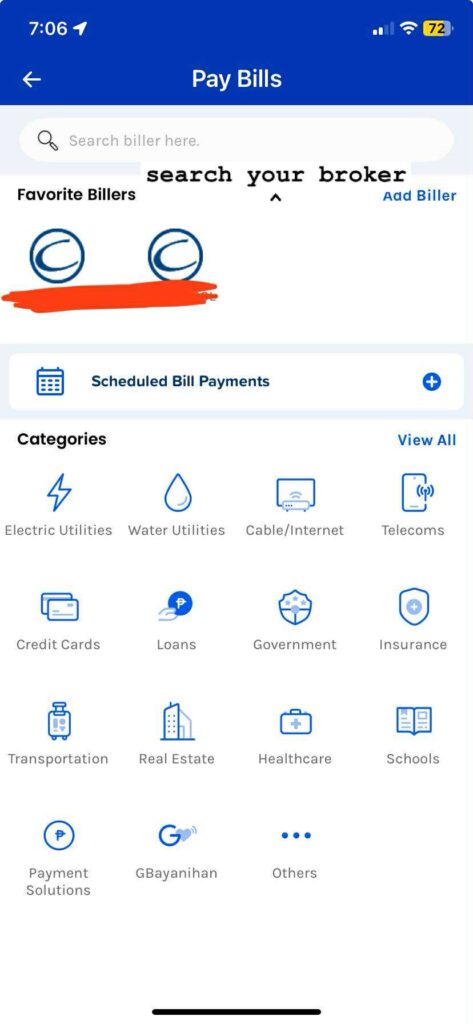

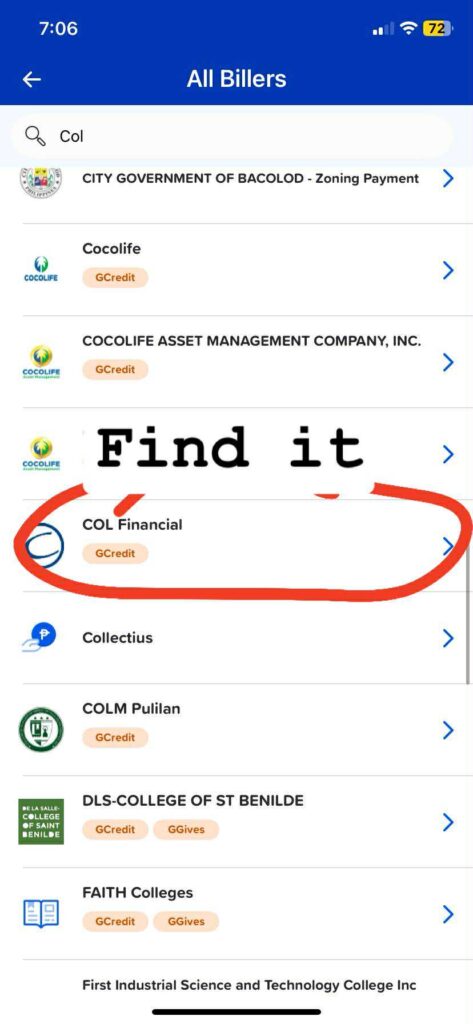

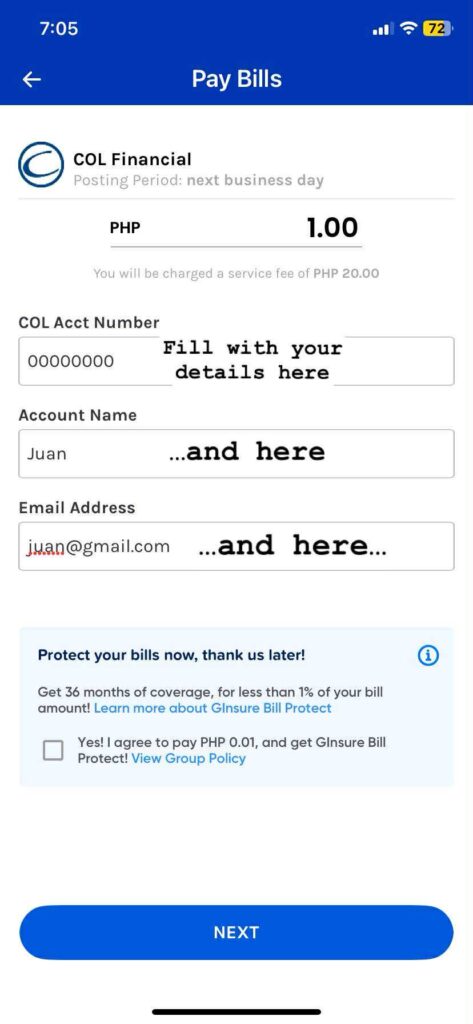

- Buying a mutual fund regularly regardless of what happens to the market. Once you’ve chosen what mutual fund you want (which can be a few or just one), what you wanna do is “regularize” your investments: PHP1000 / month every 15th of the month, you will invest in X mutual fund. We call this Peso Cost Averaging.

- Just Continue. The beauty about this strategy is that the work ends there. Make the decisions then just continue investing. The key here is to stick with it for a very very long time. Forget about doing anything fancy and, instead, focus on building your income instead.

Additionally, if you want more reading material on this, I can highly recommend A Random Walk Down Wall Street by Burton Malkiel.

For Experienced & Active Investors:

For people looking to dedicate some energy towards stocks and picking them, the following are strategies that may be valuable towards you. Just remember to manage your risk appropriately.

Best for Passive-Income Seekers: Dividend Investing

A dividend is a cash or property paid out to owners of the company (shareholders & such). Dividend investing is a popular strategy among Filipino retail investors where the focus of picking stocks lies in dividend-paying companies (note: not necessarily the highest dividend-paying companies). Among the criteria for dividend investors are:

- (Obviously) Dividend Yield

- Capacity to Pay Dividends (Payout Ratio & Free Cash Flow; and also earnings growth, etc.)

- History of Paying Dividends

One of the key concerns of dividend investing is whether or not the company should be paying dividends in the first place. Sometimes, but not necessarily often, it may make more sense for the company to reinvest their profits back into the business or just simply keep the cash on hand. Remember that dividends aren’t magic, they come at the expense of the company holding onto that cash.

Also, investors should be wary about inflation. Just because the company is paying out dividends and can pay out dividends doesn’t mean that they’re growing their capacity to pay dividends.

Best for Patient Investors: Value Investing

Value investing is a less popular, but still prominent strategy among Filipinos of buying undervalued companies. It, basically, involves guessing the value of what a company’s stock is actually worth using some models such as the Discounted Cash Flow Model. Among the key concerns of value investors are:

- Stock price relative to the value (and keeping in mind a sufficient margin of safety)

- Safety of a company (if it is undervalued, is it rightfully undervalued or is there some risk involved?)

- A “catalyst” (what will cause the price to correct? Not all consider this, but some do).

The primary book I can recommend for this type of investor is really: The Intelligent Investor by Benjamin Graham. The primary promise of this strategy is buying companies at a “discount” to their actual value which can mean huge profits for the patient investor. It also allows you to develop the skills to acquire companies for a discount.

Best for Risk-Takers: Growth Investing

Growth investing is a strategy of choosing companies with high-growth in earnings enough to outpace the growth in earnings. Usually, these companies trade more expensively than value stocks (this means they have a higher P/E ratio). It’s generally used in technology stocks (companies that have very little earnings today, but will potentially have higher earnings tomorrow). Among the key criteria for choosing an investment in the growth space:

- Feasibility of Growth (Taking into account market size and the actual plans)

- Capital at Risk (Usually, these are companies that are more risky, which requires that you appropriately manage).

Although this strategy is less popular (because there aren’t as many growth opportunities in the Philippines), investors may actually want to look into small businesses as investments as they may have the growth that investors are looking for. While most stocks trade at a P/E ratio of 8 – 20, some businesses can return in up to 1-3 years, but require a lot more effort from the owners. Still, it may be the only feasible form of “growth investing” here in the Philippines.

Best for Overall Investment: Moat Investing

While this is probably the least well-known form of investing, it’s actually the form of investing headed by Warren Buffett. The idea is to: “Buy wonderful companies at fair prices.” So, what’s a moat? A moat is basically a company’s durable competitive advantage. As such, the primary concerns for this type of investor are:

- The actual moat (what is the durable competitive advantage?)

- Profitability gained from the moat (if the company does have a moat, does it actually profit from it)

- Efficiency metrics (such as Return on Equity)

One book I’d recommend is the Warren Buffett Way: 3rd Edition by Robert Hagstrom. He calls this form of investing: Focus investing, but broadly, I think if you were to categorize this form of investing and thinking, it’s more akin to Charlie Munger’s way of investing in companies with a moat. Hence, the term: moat investing.

Which one is the best?

Broadly, none of them are. In my studies of investing, most people do well based on what the market is doing, but one thing is for certain: usually, sticking with the investment strategy is more important than implementing the most optimal one and I’m sure you could find ways to optimize your investments here and there.

There are also certainly people whose entire job it is to optimize their investments, but broadly speaking, most people would be better off simply putting their money aside in a mutual fund and focusing more on their careers. They’ll often get a higher rate of return by focusing on their income rather than their investments.

Conclusion

Overall, if you’re just beginning in this, I’d recommend to go for the passive way of doing this. Only after you’ve started reading and studying can you allocate a small portion of your money towards the more active investment strategies.

Glossary of Important Terms

- Stock Picking – Picking individual stocks

- P/E ratio – Price-to-Earnings Ratio. Basically, total market capitalization (price of a company) divided by their net income. For example: a company valued at PHP1B with PHP100M in net income has a P/E Ratio of 10.

- Discounted Cash Flow Model – Basically, it’s a model that values the cash flow of a business as the primary valuation. It takes into account: “what is a peso worth tomorrow? next year? the year after that? etc?” and gives a value of that peso today.